Debt Management Plan Singapore: Effective Solutions for Financial Stability

Debt Management Plan Singapore: Effective Solutions for Financial Stability

Blog Article

Why Carrying Out a Debt Monitoring Plan Is Vital for Long-Term Financial Health and Satisfaction

In today's intricate economic landscape, the execution of a Financial debt Management Strategy (DMP) arises as an important method for achieving long-term financial security and tranquility of mind. By simplifying debt commitments right into a convenient style, people not only alleviate the concerns of numerous lenders however likewise cultivate essential budgeting skills.

Understanding Financial Obligation Monitoring Plans

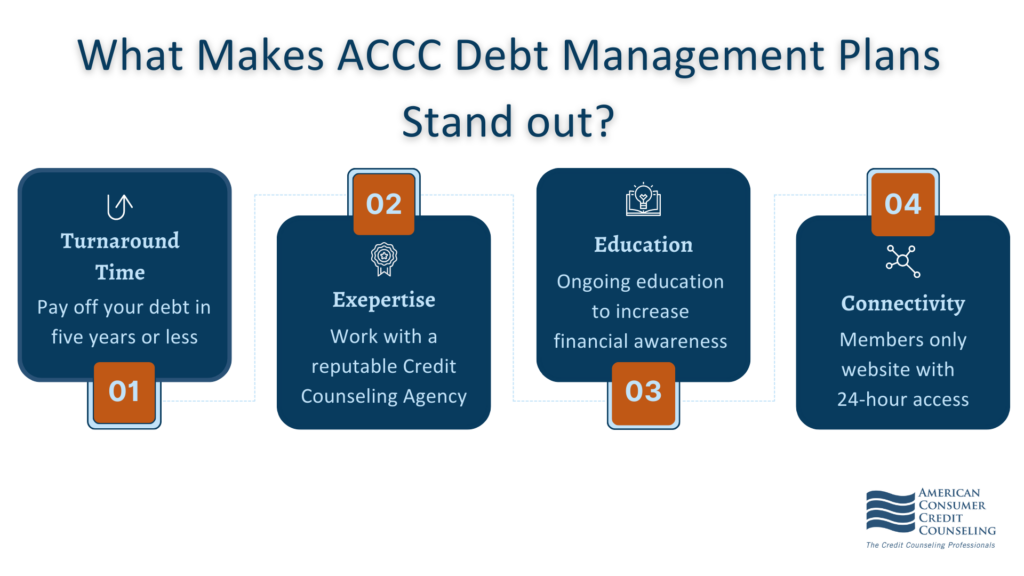

A considerable number of people deal with managing their financial obligations, making Financial obligation Management Plans (DMPs) an essential source for economic recovery. A DMP is a structured settlement plan that makes it possible for individuals to consolidate their debts into a single regular monthly payment, typically at minimized interest prices. Typically facilitated by credit scores counseling agencies, these strategies aim to simplify the debt settlement process and help people reclaim control over their economic scenarios.

The procedure begins with a complete analysis of the individual's financial circumstances, consisting of revenue, costs, and total financial debt. Based upon this examination, a counselor creates a tailored DMP that describes just how much the person will certainly pay monthly and the anticipated period of the plan. Creditors usually accept the proposed terms, which might include reduced interest prices or waived costs, making settlement much more convenient.

Benefits of a DMP

While browsing the intricacies of debt settlement can be difficult, a Financial debt Administration Strategy (DMP) uses various advantages that can dramatically relieve this problem. Among the key advantages of a DMP is the loan consolidation of multiple financial obligations right into a solitary monthly settlement, simplifying monetary monitoring and lowering the likelihood of missed settlements - also found here. This structured strategy can bring about lower passion prices bargained by credit history therapy firms, inevitably reducing the total cost of debt in time

Additionally, effectively completing a DMP can positively influence one's credit report, as consistent payments show monetary responsibility. Overall, the benefits of a DMP extend beyond plain financial debt decrease, fostering a feeling of empowerment, monetary stability, and lasting peace of mind for those committed to boosting their monetary health.

Actions to Carry Out a DMP

Executing a Debt Monitoring Plan (DMP) involves numerous essential actions that make sure a smooth transition right into a structured repayment procedure. The initial step is to evaluate your financial scenario by collecting details on all financial debts, revenue, and expenditures. This thorough sight enables far better preparation.

Following, it's suggested to look for support from a trusted credit history counseling firm. These experts can aid you comprehend your alternatives and guide you in developing a tailored DMP that fits your monetary demands. They will certainly work out with your creditors to reduced passion prices and establish a workable repayment timetable. as soon as you've picked an agency.

After reaching a contract, you visit site will certainly make a solitary month-to-month settlement to the agency, which will then distribute the funds to your financial institutions. It's important to dedicate to this layaway plan and stay clear of building up added financial debt during the repayment period.

Overcoming Common Obstacles

Navigating a Financial Obligation Monitoring Strategy (DMP) can offer different obstacles that may impede progress. One of the most common barriers is the emotional strain associated with taking care of financial debt.

Additionally, some people might fight with the self-control needed to stick to a stringent spending plan. Developing a practical spending plan that represents both necessary expenses and optional spending can aid preserve conformity with the DMP. Routinely reviewing and changing the budget as required is also critical.

Finally, there might be a lure to sustain new financial debt, which can severely threaten progression - also found here. Establishing clear economic goals and understanding the lasting benefits of the DMP can aid preserve focus and hinder spontaneous spending

Long-Term Financial Approaches

Efficiently handling a Financial debt Administration Strategy (DMP) not just involves getting over prompt challenges yet also calls for a positive strategy to monetary health. Lasting financial approaches are necessary to make certain that people not just minimize their current financial debt however also construct a stable structure for future financial well-being.

Among one of the most essential approaches is budgeting. Creating an extensive regular monthly budget plan enables individuals to track earnings and costs, making sure that they designate adequate funds towards debt repayment while also setting apart cash for financial investments and cost savings. Furthermore, establishing a reserve can offer a monetary buffer against unexpected costs, lowering the likelihood of incurring new debt.

Purchasing monetary education is one more essential element. Recognizing the dynamics of credit history, rate of interest rates, and investment options equips individuals to make educated decisions. Moreover, establishing clear monetary goals-- such as saving for retired life or acquiring a home-- can supply motivation and instructions.

Final Thought

In conclusion, carrying out a Debt Administration Strategy is important for fostering long-lasting economic health and wellness and achieving tranquility of mind. By streamlining financial debt payment, encouraging self-displined budgeting, and promoting economic education, a DMP equips individuals to gain back control over their funds.

In today's complicated financial landscape, the implementation of a Debt Monitoring Plan (DMP) arises as a vital approach for accomplishing long-term financial security and peace of mind.A find more information substantial number of individuals have a hard time with managing their financial obligations, making Financial debt Monitoring Plans (DMPs) a crucial resource for financial healing.While browsing the complexities of debt repayment can be difficult, a Financial obligation Administration Plan (DMP) provides numerous advantages that can dramatically reduce this worry. One of the key benefits of a DMP is the debt consolidation of several financial debts into a single month-to-month repayment, simplifying financial monitoring and minimizing the possibility of missed payments. By simplifying financial obligation repayment, urging regimented budgeting, and promoting economic education and learning, a DMP equips find out this here people to reclaim control over their financial resources.

Report this page